A convergence of economic, social and geopolitical factors - in addition to losses related to social inflation, natural catastrophes and Covid-19 - claims inflation catapulted to unprecedented levels in 2022. With many claims taking longer to resolve and the cost of reinstatement often significantly higher than insured values, serious challenges continue to be present for both insurers and policyholders.

Claims costs began rising for a combination of reasons, many of them interlinked. Port closures and restrictions on the movement of goods and people during the pandemic limited the supply of goods, labour and components, slowing global production and driving up the

price of essential commodities, materials and parts.

The war in Ukraine, including sanctions on Russia, exacerbated many of these problems and triggered further sharp rises in energy and commodity prices.

Additional global factors, from Brexit in the UK to climate change, are also continuing to drive cost inflation. Extreme weather events in recent times, such as the 2022 Australian floods, and also flooding events in Pakistan, droughts in Canada and South America, and several Hurricanes in the US, have added to the scarcity of goods and materials, driving up prices.

Rising energy, transportation, and goods costs, combined with labour shortages, rising rents and increased borrowing costs, all contributed to a rise in the cost of doing business.

The result was a perfect storm for claims inflation in multiple classes of business.

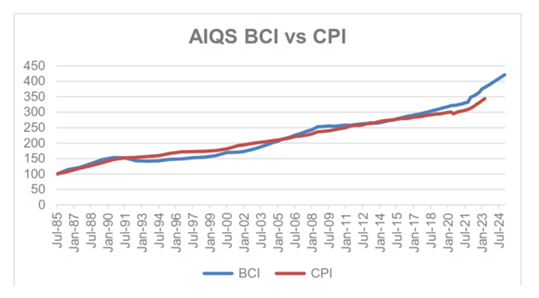

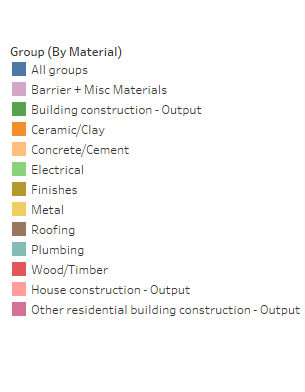

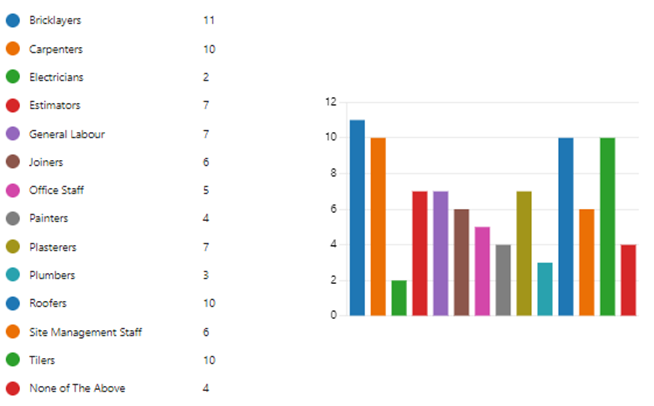

In property, claims costs have been inflating and indemnity periods extended due to dramatic rises in the cost of materials, global supply issues and labour shortages. This coincided with an uptick in demand in markets like the US and UK, where there has been a boom in demand for homebuilding and renovations post-pandemic. Meantime, delays caused by labour and supply shortages have extended business interruption claim periods.

In motor, there was a time of challenge obtaining specific parts, components, and skilled labour, particularly for electric vehicle repairs. The rising cost of vehicle repairs for insurers continues to be exacerbated by the increasingly sophisticated technology in modern cars, while personal injury pay outs are also rising in severity.

This is linked to social inflation, which has already caused claim costs to sky-rocket in various casualty classes including D&O. Professional lines like cyber are also seeing significant claims inflation due to the increasing frequency and severity of cyber-attacks as well as new and emerging exposures due to geopolitical instability.

A further factor affecting insurance market dynamics is the growing risk of under-insurance on the part of policyholders due to coverage being purchased based on outdated asset valuations which do not factor in the impact of inflation.

In addition to common factors such as rising energy and fuel prices, supply chain disruption and labour shortages, inflation drivers certainly vary by market and region.