xsource.com.au I T: 02 8669 9686 I contact@xsource.com.au

LOAN PROCESSING SERVICES

take care of your clients, leave the processing to us

LOAN PROCESSING SERVICES

Broker interviews a borrower and structures a deal.

Broker should send xSource the Cover Letter, Fact Find & BID Form (unless information is already in CRM) and supporting documents via email or upload the files to Dropbox / CRM.

- xSource checks your supporting documents.

- Enters new deals in CRM and Apply Online systems and produces outputs.

- Prepares Serviceability Calculator (or checks broker’s calculation if provided).

- Prepares bank file, reduces document size if needed, removes TFNs and checks if the documents are acceptable and according to lender checklist.

- Orders Valuation and Pricing where instructed.

- Within 24 hours xSource prepares the outputs and queries and sends them back to broker for review and signature collection. Most of the time, everything is done overnight.

- Asks the broker for missing information, further confirmation and clarification where needed.

- Advises broker if loan structure needs to be adjusted according to lender policy and as per previous experience.

- Processing outputs are: Lender Application Form, NCCP documents, Lender Serviceability Calculator, Discharge Form (if applicable), FHOG (if applicable) and other forms depending on lender requirements.

- Broker answers xSource's queries and sends the signed documents.

- Broker advises if xSource needs to make any changes or include additional documents.

- xSource checks the signed documents to confirm that all required forms and signatures are there.

- xSource lodges the application through Apply Online on the same day broker responds with answers and the signed outputs are received.

- Prepares bank file for lodgement and attaches NCCP and all support files to CRM in order to stay compliant.

- Advises broker when the deal is lodged, noting application reference number and which documents were provided to the lender.

- xSource tracks loan application with lenders, valuers, solicitors and builders and escalates through broker's BDM.

- Sends outstanding documents to lenders when provided by broker and escalates.

- Keeps the broker updated all the way to settlement.

Starting from $209 + GST for Lodgement Only Service or $279 + GST for Lodge & Track Service

VIRTUAL ASSISTANT SERVICES

- Ongoing online, phone and email broker support, managing borrower relationships on behalf of the broker.

- White label service.

- Dedicated VOIP line and branded email address.

- Answers all incoming calls on broker's VOIP line.

- Provides client support for existing deals or issues.

- Collects the initial information for new leads.

- Customer Service office uses a dedicated phone line and email account.

- Provides regular client progress updates from lodgement to settlement.

- Guides clients through settlement process.

- Manages switching requests.

- Provides general post-settlement support.

- Manages client post-settlement milestones (birthdays, fixed rate and interest only expiry dates).

- Online valuation ordering, where available and requested.

- Online pricing requests, where available and requested.

- Our Virtual Assistant is available on business days from 9 a.m. until 5 p.m. via email or phone line.

Starting from $2,800 + GST for VA part time service + 5 applications for loan processing

PARABROKING SERVICE

WHAT WE OFFER

Our parabroker can provide you with:

- Lender policy research;

- Borrowing capacity calculations;

- Document verification;

- Communication with lenders and BDMs;

- Data entry and lodgement;

- Pipeline management and more.

Our Parabroking Service includes a limited number of dedicated parabrokers, with extended duties and services.

Our parabroking staff are fully qualified and have more than five years of experience at xSource.

PROCESSES IN PLACE

Benefits of using our Parabroking Service:

- You get a dedicated parabroker and personalised service, ensuring easy fit in your team and existing processes.

- Our staff are trained and experienced in industry, removing any need of your time investment in their training and development.

- Using our parabroker, you will significantly improve your productivity and revenue by having extra time to focus on lead generation and customer retention.

- With full time and part time parabroking support offering, our service provides you with full flexibility to grow your business.

Starting from $2,750 + GST

COMPLIANCE CHECK

MANAGING COMPLIANCE PAPERWORK

- Confirming all required supporting documents are securely uploaded to the CRM.

- Protecting sensitive data by removing TFN/CRN numbers from all files.

- Ensuring every NCCP document is correctly signed, dated, and filed.

- Meeting every requirement outlined in the aggregator’s compliance checklist.

- Reviewing all lender documentation for accuracy and completion.

CREDIT ASSESSMENT

- Verification of property ownership using details such as the title deed or property address.

- Detailed review of borrower-provided asset information, including serial numbers and VINs.

- Secure collection of personal identification and authorisation for credit checks.

- Thorough examination of the completed loan application and all supporting documents.

- Identification verification to confirm the borrower or guarantor’s bankruptcy status.

- Verification of KYC documents, such as ID, utility bills, and proof of income.

- Clear, consolidated summary of findings from all searches and assessments.

- Delivery of a finalised credit processing report to your lender.

DATA SECURITY

THE XSOURCE GROUP

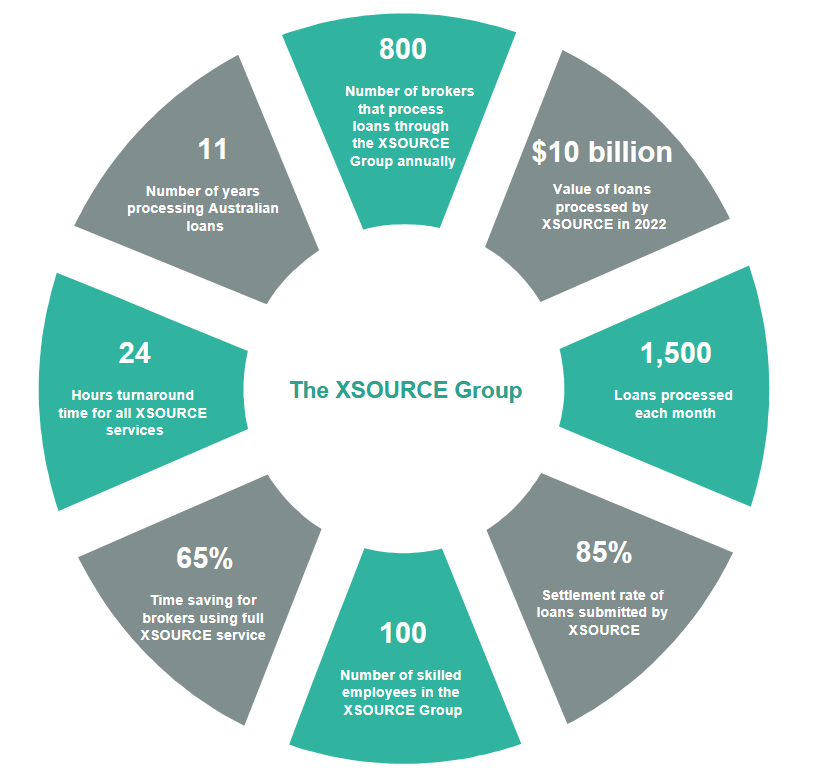

- The xSource Group is a loan processing and productivity specialist, processing over 10 billion dollars worth of loans per year.

- The xSource Group has spent years processing thousands of loans across a plethora of lenders, aggregators, workflow systems, compliance regimes and service providers in the sector from marketing services to administrative assistants.

- The xSource Group receives over 350 new enquiries from mortgage brokers each year.

- The xSource Group has offices in Australia (Sydney) and Serbia (Belgrade, Novi Sad, Zrenjanin).

- Every single workplace is based in business district in all of the aforementioned cities with secure and stable internet and electricity connection.

- All our offices are secured with access control and are under 24h surveillance that prevents any unauthorised personnel from entering the premises.

- The office computers are secured with passwords, screen locks and top of the line network security software.

- All of your data is kept on a server based in a secure data room in Europe only accessible via office computers.

- In terms of the passwords, every single password is well secured on LastPass and at all time not visible to anyone except the office administrator in charge of the security.

- xSource Pty Ltd has its own Personal Indemnity Insurance.

- All data is shared with brokers and we are securely disposing the data that we don't need anymore (settled and old deals).

- The xSource Group has over 100 employees, all trained in every CRM available to mortgage brokers, including Salestrekker, MyCRM, Mercury Nexus, Flex, Infynity and many more.

- All employees go through extensive security checks before getting a chance to become a part of our business. Once this step is completed, a series of complex tests are conducted.

- All our employees need to sign a privacy policy document, required as per standard work regulations.

- We can revoke employee's access to systems and premises as soon as any of them leave the company.

- All employees are trained in Australian privacy awareness and computer security.

- Over 60% of the people employed by xSource Group have more than 7 years of experience in Finance and Mortgage Broking.

- Among them, more than 20 employees including all team leaders have completed Certificate IV and Diploma in Finance and Mortgage Broking.

- All of our employees are highly proficient in spoken and written English.

- Our Onboarding Specialist will help you get familiarised with the process we have, so that you can have an easy transition.

- Every deal is going through quality check which is performed by our team leaders.

- We are also regularly doing quality reviews of our work and processes.

- Our employees are having regular training regarding current offers and changes in broking sector.

- We have incident and breach reporting system in place and it is in line with the notifiable Data Breaches Act.

- Applications are prepared overnight and ready for signing the next morning.

- We also have another Processing Team working during business hours in Australia, dedicated specifically to urgent tasks and submissions.

- xSource Follow Up Team is also available during business hours in Australia and can assist with any request for applications already submitted.

- xSource provides branded Cover Letter and Fact Find documents.

- We offer plenty of documents and video tutorials to help you understand our process.

xSource company holds ISO/IEC 27001:2022 certificate ensuring we meet all the requirements for maintaining and continually improving an information security management system within the organization.

OUR TEAM AT XSOURCE

In 2022 XSOURCE was celebrating 10 years of providing services to the mortgage brokers in Australia. We got together to celebrate our milestone. Here are some snapshots from our 10th birthday party.