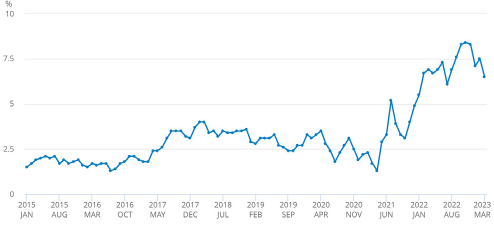

The UK Motor market saw premium rate reductions immediately after the pandemic, as insurers profited from the reduction in traffic and accidents during lockdowns and as working patterns and trends changed for the year ending June 2022 (UK Government, November 2022).

This has been short lived as accident figures “broadly show a return” to pre pandemic trends for the year ending June 2022 (UK Government, November 2022). Lighter exposures (private cars and vans) benefited most from this, with the heavier exposures still seeing increases due to increased loss potential and a lack of market competition. For Motor, this includes Haulage and Logistics, Couriers and Motor Trade, especially for Prestige and Self Drive Hire fleets.

The far more pressing issue for Casualty and in particular Motor insurers is the rise in claims costs and inflation in 2022 which is seeing insurers push for double digit rate increases even on well performing Fleets. This is due to Advanced Driving Assistance Systems (ADAS) and other new technology in vehicles which may reduce the frequency of accidents, but has a negative impact on repair costs.

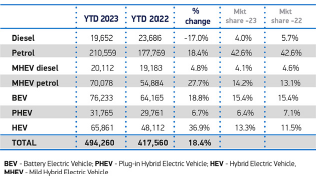

The rapid growth in demand for electric vehicles also increases repair costs alongside the inflated credit hire costs and vehicle write offs arising from the lack of availability of vehicles and parts from Europe since Brexit, Covid, the invasion of Ukraine and the severe automotive supply chain restrictions which are beginning to ease in 2023.

Ukraine produces 50% of the worlds’ neon which is needed for the production of semiconductor chips (Reuters, March 2022), along with wire harnesses, nickel and palladium used in electric batteries and catalytic convertors.

The UK also imports 80% of its automotive components from the EU (ACEA, March 2022) and the fallout from Brexit, energy price increases and a weakening pound has inflated prices. Lockdowns in China also continue, which is a major manufacturing and logistics centre for ancillary parts.

The average used car price has increased by £3,300 in two years since the pandemic (Auto Trader, August 2022) and dealerships reported a 27% increase in used car prices in H1 2022 (Yahoo Finance, August 2022). New car registrations fell by 24.3% in the UK in 2022, the weakest performance since 1996 (SMMT, July 2022).

Theft and fraud are at record levels, which is often seen during economic downturns, whilst catalytic converter theft (which contain precious metals that have risen substantially in price) rose over 100% in 2020 and 2021. The theft of keyless vehicles from relay attacks is at an all time high especially for luxury vehicles such as Range Rovers (Allianz, December 2022).

The Motor repair market is also experiencing serious labour shortages for electric vehicle repairs, with only 6.5% of the motor mechanic workforce qualified to service electric vehicles (Institute of the Motor Industry, January 2022).

All of the above mean insurance premium growth has not kept up with claims inflation in 2022. The insurance market has therefore started to harden with a number of insurers seeking rating increases across their portfolios. Motor fleet remains an area of selective acceptance, with many large insurers only writing motor in conjunction with other profitable lines of business.

Motor insurers are looking to increase rates by 10-20% on average performing risks.

Fleet operators with good risk management controls might benefit from repricing their risk. However, this will require a risk analysis that produces the data needed to attract the interest of insurers with a broker that specialises within the sector.