Tax Service Success Kit

Q4 2025

From your Client Success Team

Aligning the stars for your Q4 success

Your guide for the season ahead

All year long, we align each part of our process—every report, every quality check, every employee training, and every product refinement—like stars forming a constellation. Together, these steps create a clear path, guiding us and our clients toward a smooth and successful Q4.

Q4 is a busy time of year for tax servicing. 75%+ of the nation’s taxes are due between October 1st and December 31st. We are committed to constant process improvements and efficiencies that drive success in your business and in ours. We prepared this Success Kit to provide you with important items to review and consider before October begins. We will be ready, and we will ensure you are too.

It is imperative that any legal descriptions are provided for tax contracts that could not finish the search process without one. Your Inadequate Legal Description (ILD) Report is housed on LERETAnet. Please provide these legal descriptions as quickly as possible so we can ensure a timely request of all tax bills.

Need a refresh? Watch our quick (less than 60 seconds!) video created by our client experience team.

Please submit your legal descriptions within LERETAnet.

Mass Payment Return Dates, commonly referred to as MPRD, are listed on the Tax Amount Report. This is the deadline to have your funds to LERETA for your mass payments.

A BLANK Mass Payment Return Date on your tax amount report means that payments need to be sent by you, to the tax agency directly.

A blank Mass Payment Return Date will occur when there are delays receiving the tax amounts from the agency. Unfortunately this shortens the timeframe for everyone to submit payments and LERETA is unable to support the remittance process on your behalf, payments must be made directly to the agency.

Tax Amount Reports Exceptions are loans under service that are actively being reviewed and will be reported to you on a Direct Pay Supplemental Clean Up file.

A blank date will occur for newly added parcels that were not on the original tax bill request, these will be labeled as "supplemental" and require you to pay directly to the agency.

If funds are sent to LERETA for a blank Mass Pay Return Date, they will be returned to you and may delay your payment process. It's very important to make note of this date to minimize any interruptions.

📢The last day to remit funds to LERETA for delivery to the agency before year end is: 12/17/25

For extended processing in Wisconsin, to adhere to state specific legislation, please refer to the WI section below.

A preferred year end state is defined as a state where tax agencies publish bills for payment before the end of the year but the economic loss doesn’t occur until the new year. For example, in Michigan the economic loss date is in February, however, many lenders prefer to pay in December because the bills are available.

Preferred year end states will be published to your tax amount reports in LERETAnet, however, if you require these payments to be posted by the tax collector prior to 12/31/2025 please remit your payments directly to the tax office.

If you elect to pay through LERETA we are happy to support you, however, the payment will likely be delivered to the tax collector after December 31st due to the priority of getting year end taxes paid timely for all our clients.

Check your "Transmittal" tab in the LERETAnet Tax Amount Report for details on the mass pay return date for these agencies. For questions, reach out to our payment team directly at pct.taxpmt.group@LERETA.com

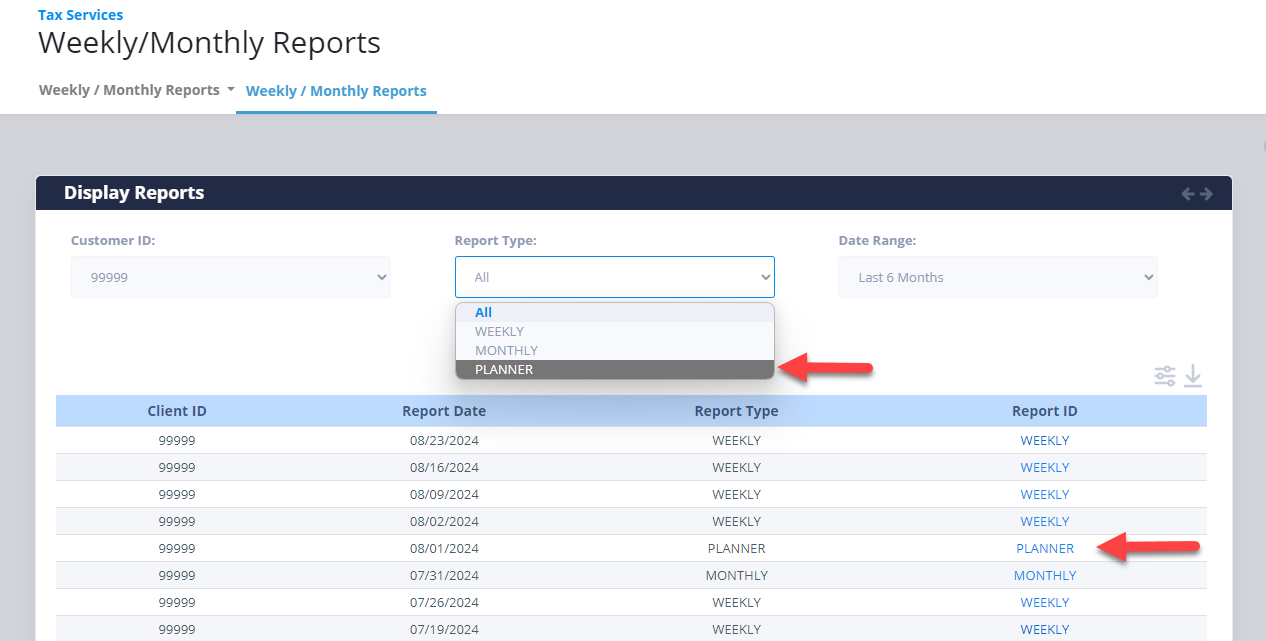

The Planner feature in LERETAnet will provide an estimated schedule of when to expect agency tax amount reports. Reference this page for any questions on when reports will be available.

If you have a tax amount report without a Mass Pay Return Date, please reference our section above concerning "What to do if a Mass Pay Return Date is BLANK".

To access the planner, Tax Services > Weekly/Monthly Reports > Select Planner from the Report Type dropdown or choose it from the report list.

To review all your active contracts, sign onto LERETAnet.com → click on view/maintenance existing contract → enter search criteria.

- Are there any active contracts on paid in full loans? Reduce your future work by cancelling these contracts.

- Are the contracts appropriately categorized as escrow and non-escrow (C Service & B Service respectively)? Synching service types will ensure you receive the type of reporting you need quickly.

- Do you have active loans on your system that are not contracted? Now is the time to ensure they are added for future reporting.

- Do you have additional collateral to add to an existing contract? Please submit these as quickly as possible by accessing LERETAnet’s main page/News & Updates.

If you are anticipating the acquisition of a new loan portfolio or selling off a current portfolio during Q4, please notify your Client Success Manager as quickly as possible.

Haven't logged in recently? Perhaps you are using additional resources during Q4. Take a moment to check your User IDs and Passwords. If any credentials need to be re-set or you need to request access for a new user, please email our Customer Service team at taxcustcare@lereta.com.

We invite you to take advantage of LERETA University. LERETA University offers self-paced online courses and quick reference guides if you or your teammates would like a refresher. If you are short on time, and prefer not to go through the entire course, you can select specific topics of interest…the option is yours!

A list of covered topics include:

- Introduction to Real Estate Tax Servicing

- Ordering a new tax contract

- Viewing and maintaining existing contracts

- Customer service requests and how to provide documents

- Agency profiles and bulletin boards

- Escrow servicing - accessing and viewing reports PLUS the edit and balance feature

- Delinquency reports - generating letters

As always, we are here to support you and your team!

Paying Wisconsin Property Taxes

Many clients have questions regarding the nuances of Wisconsin taxes, review payment options below!

Verify your Wisconsin payment options

- Option 1 = LERETA provides annual amount to be disbursed from the escrow account with a check by 12/18

- Checks should be payable to the taxpayer and the tax collector, disbursed by the lender and mailed to the taxpayer

- 2025 tax amounts will be available in LERETAnet mid to late January for any updates to your tax lines

- Option 2 = Annual amount to be disbursed from the escrow account and paid to agency in full by 12/31.

- 📢The last day to remit funds through LERETA for payment option 2 is 12/22/2025.

- Option 3 = Annual amount to be disbursed from the escrow account and paid to the agency in full by the due date 1/31

- Option 4 = Installment amount to be disbursed from the escrow account and paid to the agency by the due date of 1/31 and subsequent installment due dates

- Option 1 = LERETA provides annual amount to be disbursed from the escrow account with a check by 12/18

Complete your WI Option Audit Timely!

Options must be promptly updated in LERETAnet and included for all new loans moving forward. A bulk upload tool is available for a mass update.

Option updates must be completed before November 4th, anything not updated will default to option 2.

**Options CANNOT be changed during the escrow cycle, November 5th through January 31st**

Need to see the audit in action? Kari Anhorn, LERETA Client Success Manager, will walk you through the process → watch the video below!

Paying Texas Property Taxes

Many clients have questions regarding the nuances of Texas taxes, review our FAQ quick guide below

LERETA does not support Texas installment reporting and will indicate these with a Handle Manual Code.

LERETA reports exemptions as $0.00 with a PAID indicator and an EXEMPT Handle Manual Code. This is true for all states, Texas happens to have a high percentage of these which prompt frequent questions.

Texas residents receive their appraised values by April 30 and have until May 31 to file a written protest of their value.

In Texas, if the values are being formally protested by the homeowner, the property is considered “Not Certified”. The protest affects all collecting agencies. If there are three tax lines on a property (County, City, and School) then all three will be Not Certified.

LERETA delays assigning a “Not Certified” Handle Manual Code until after receipt of the Supplemental Certified Roll from the CAD in December. After the December supplemental certified roll, LERETA will apply the “Not Certified” Handle Manual Code. This delay allows the lender an opportunity to remit payment via the LERETA Tax Payment program.

If a property is reported with a "Not Certified" Handle Manual Code, LERETA follows up on the 10th of each month until an amount is released and reports via the Handle Manual process.

Section 25.025 of the Texas State Tax Code allows for Peace Officers, their families, members of the Criminal Justice Department and citizens who are under the threat of violence to have their name and address information removed from tax collector websites.

This section does not prohibit the public disclosure of information in appraisal records that identifies property according to an address if the information does not identify an individual who has made an election under Subsection (b) in connection with the individual’s address.

LERETA makes best efforts to procure tax amounts for these accounts. If we are unable to procure the information, the Confidential Account Handle Manual Code will be used to indicate that the borrower needs to be contacted directly for the tax amount due.

Align Your Q4 with LERETA

Have more questions? Contact your Client Success Manager directly or our Customer Care Team at 888.534.5283 or email us at taxcustcare@lereta.com.